Certificate of Origin (C.O) plays an important role in import from China business, many international customers and buyers need the Certificate of Origin when importing from China, but sometimes they may get confused to choose C.O and Form A because there are different kinds of C.O in China. We have exported for many years as a furniture manufacturer in China, and we have good experience in Certificate of Origin China, here we will explain all the types of C.O in China, you will know all details about it after reading this post, let’s get started.

What is Certificate of Origin?

Certificate of Origin (also called C.O) is a certificate that certifies the origin country/region of specific imported and exported goods, that is, it proves that a batch of goods originated in a certain country or region, or was manufactured in a certain country or region. Its main function is to apply for tariff reduction and exemption in importers’ country (the main purpose of Preferential Certificate of Origin) or to facilitate the importing country to carry out specific international trade control (the main purpose of Non-preferential Certificate of Origin).

For example, China and Pakistan have signed the “China-Pakistan Free Trade Agreement” in 2006, China exporters can apply for the Certificate of Origin China-Pakistan FTA (referred to as FORM P) as long as their products exported from China to Pakistan comply with the “Origin Rules of the China-Pakistan Free Trade Agreement”, Pakistan importers & buyers can get certain preferential treatment such as tariff reduction or exemption after they get the Certificate of Origin China-Pakistan FTA (FORM P) issued by China official agency.

Another example, we all know the United States imposes economic/military sanctions on Iran, so some products originating in or manufactured in Iran cannot be exported to the United States or are subject to strict restrictions.

What are the uses of the Certificate of Origin?

The Certificate of Origin plays a very important role in importing & exporting business, it is hard to clear custom without C.O in some countries and regions. C.O is also an important document for importing country’s custom to decide tariffs. Importers who have the preferential Certificate of Origin (Such as Form A) can get reduction or exemption treatment in tariff.

Main uses of C.O for importing countries are:

- The main basis for determining the tax rate treatment (whether to grant specific preferential treatment or not).

- An important basis for international trade data (statistics of the country/region of origin for imported goods).

- The basis for the implementation of foreign trade control measures such as import goods quantity control, anti-dumping and countervailing measures (determine which foreign trade control measures are applicable according to the place of origin).

- Control the goods from specific countries and the basis for approval or not (specific control based on the “nationality” of import goods).

- Proof of the goods’ intrinsic quality or the basis for foreign exchange settlement.

What are the three major types of Certificate of Origin?

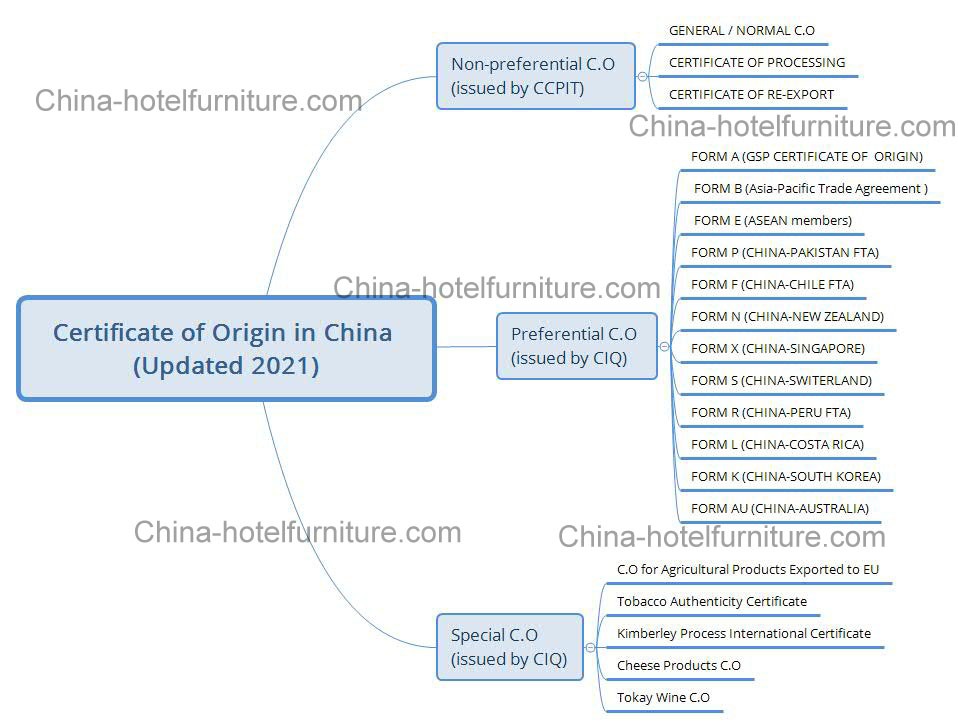

The certificates of origin issued by China for export goods are mainly divided into three categories: Non-preferential C.O, Preferential C.O and Special C.O.

Non-preferential C.O

There are 3 kinds of certificates in Non-preferential C.O:

1.General Certificate of Origin

Also called Normal certificate of origin, those who issue this certificate are usually exported to countries in the Middle East, Africa, Southeast Asia, Central and South America, etc.

2.Certificate of Processing

It refers to all or part of the imported raw materials or parts used for processing and assembly of export goods in China, when, this certification document would be issued by China official agency in accordance with the application of the exporter certifying that China is the processing and assembly place of exported goods if it does not meet China origin export goods standard and fails to obtain the normal certificate of origin.

3.Certificate of Re-Export

It refers to foreign goods that are re-exported through China. Since normal certificate of origin cannot be obtained under this situation, China official agency would issue certificate of re-export to proof that the goods are produced in other countries and are re-exported through China.

Preferential C.O

What is Preferential C.O? It is mainly used to enjoy preferential treatment such as tariff reduction or exemption during goods importing, and it can be divided into unilateral GSP certificates of origin (also called FORM A, 39 developed countries, except the United States) and reciprocal regional preferential certificates of origin (such as FORM B, FORM E, FORM P, FORM X etc) .

1.Certificate of Origin FORM A

FORM A is issued in accordance with origin rules of the GSP preferential country and related requirements is FORM A certificate. It is the certificate of origin for the preferential treatment of GSP tariffs when goods from beneficiary countries (mainly developing countries) are exported to favored countries (mainly developed countries). The goods listed on the FORM A certificate are eligible for tariff reduction or exemption only if they comply with the GSP rules of the corresponding preferential country.

The Generalized System of Preferences, or GSP for short, is a tariff system refers to a tariff preference system for manufactured or semi-manufactured products exported from developing countries or regions to developed countries or regions, it is universal, non-standard, discriminatory and non-reciprocal, which is significantly different from reciprocal and non-universal certificates of origin such as FORM B, FORM E, FORM F, and FORM P etc. GSP aims at increasing the export income of developing countries, promoting their industrialization, and accelerating their economic growth in long term.

There are 40 countries have granted China’s GSP treatment (as of 2021) : 28 EU countries (Belgium, Denmark, United Kingdom, Germany, France, Ireland, Italy, Luxembourg, Netherlands, Greece, Portugal, Spain, Austria, Finland, Sweden, Poland, Czech Republic, Slovakia, Latvia, Estonia, Lithuania, Hungary, Malta, Cyprus, Slovenia, Bulgaria, Romania, Croatia), Norway, Switzerland, New Zealand, Liechtenstein, Turkey, Russia, Belarus, Ukraine, Kazakhstan, Japan, Canada and Australia.

2.Certificate of Origin FORM B

It is an official certificate of origin issued in accordance with the origin rules of the Asia-Pacific Trade Agreement, and enjoys reciprocal tariff reduction or exemption for specific products between the members of this agreement, it is different from the non-reciprocal FORM A certificate. All members of the Asia-Pacific Trade Agreement can issue FORM B certificates, these countries are: China, India, Sri Lanka, Bangladesh, Laos and South Korea.

3.Certificate of Origin FORM E

It is issued in accordance with the “China and the Association of Southeast Asian Nations Comprehensive Economic Cooperation Framework Agreement”, all the members enjoy reciprocal tariff reduction or exemption of specific products from this official origin certification document. All ASEAN members can issue FORM E certificates since July 20th 2005, these countries are: China, Laos, Vietnam, Thailand, Myanmar, Cambodia, Philippines, Brunei, Indonesia, Malaysia and Singapore.

4.Certificate of Origin FORM P

FORM P also known as CERTIFICATE OF ORIGIN CHINA-PAKISTAN FTA, it is issued in accordance with the “China-Pakistan Free Trade Agreement” and “China-Pakistan Free Trade Area Rules of Origin” between China and Pakistan to enjoy reciprocal tariff reduction or exemption for specific products since 2006.

5.Certificate of Origin FORM F

FORM F also known as CERTIFICATE OF ORIGIN FORM F FOR CHINA-CHILE FTA, the China-Chile Free Trade Agreement (the first free trade agreement between China and Latin American countries) has been officially implemented since Oct 1st 2006, nearly 6,000 kinds of products can enjoy zero tariff preferences with the FORM F certificate issued by official agency in both China and Chile.

6.Certificate of Origin FORM N

FORM N also known as CERTIFICATE OF ORIGIN FORM FOR THE FREE TRADE AGREEMENT BETWEEN THE GOVERNMENT OF THE PEOPLE’S REPUBLIC OF CHINA AND THE GOVERNMENT OF NEW ZEALAND, it is an official document issued in accordance with the Free Trade Agreement between the China Government and the New Zealand Government on the mutual tariff reduction and exemption treatment since Oct 1st 2008.

7.Certificate of Origin FORM X

FORM X also known as CHINA-SINGAPORE FREE TRADE AREA PREFERENTIAL TARIFF CERTIFICATE OF ORIGIN, it is an official document issued in accordance with the Free Trade Agreement between the China Government and the Singapore Government on the mutual tariff reduction and exemption treatment since Jan 1st 2009.

8.Certificate of Origin FORM S

FORM S also known as CERTIFICATE OF ORIGIN USED IN FTA BETWEEN CHINA AND SWITERLAND, it is an official document issued in accordance with the Free Trade Agreement between the China Government and the Swiss Confederation on the mutual tariff reduction and exemption treatment since July 1st 2014.

9.Certificate of Origin FORM R

FORM R also known as CERTIFICATE OF ORIGIN FORM FOR CHINA-PERU FTA, it is an official document issued in accordance with the Free Trade Agreement between the China Government and the Peru Government on the mutual tariff reduction and exemption treatment since Mar 1st 2010.

10.Certificate of Origin FORM L

FORM L also known as CERTIFICATE OF ORIGIN FORM FOR CHINA-COSTA RICA FREE TRADE AGREEMENT, it is an official document issued in accordance with the Free Trade Agreement between the China Government and the Costa Rica Government on the mutual tariff reduction and exemption treatment since Aug 1st 2011.

11.Certificate of Origin FORM K

FORM K also known as CERTIFICATE OF ORIGIN FORM FOR KOREA-CHINA FTA, it is an official document issued in accordance with the Free Trade Agreement between the China Government and the Costa Rica Government on the mutual tariff reduction and exemption treatment since Dec 20th 2015.

12.Certificate of Origin FORM AU

FORM AU also known as CERTIFICATE OF ORIGIN FORM FOR CHINA-AUSTRALIA FREE TRADE AGREEMENT, it is an official document issued in accordance with the Free Trade Agreement between the China Government and the Australia Government on the mutual tariff reduction and exemption treatment since Dec 20th 2015.

Special Certificate of Origin

Soecial C.O is for special products in some industries according to the special needs of import and export supervision, such as agricultural products, wine, tobacco, cheese products, rough diamonds, etc., these special products must comply with certain origin rules before they can be legally imported or exported. The basis for special C.O is a bilateral or multilateral agreement signed between different countries or regions.

Here are some example of special C.O: Certificate of Origin for Agricultural Products Exported to EU, Tobacco Authenticity Certificate, Kimberley Process International Certificate, Handmade Products Certificate of Origin, Certificate of Origin Marking, Certificate of Cheese Products, Tokay Wine Certificate of Origin, and Certificate of Authenticity for Emperor Wine.

What’s the difference between FORM A and normal CO?

FORM A (FORM B, FORM E, FORM AU etc) is preferential C.O, mainly used to enjoy preferential treatment such as tariff reduction or exemption in the importing country, buyers would pay more tariff if he don’t have this certificate, there are also restrictions in the countries who can apply FORM A.

Normal C.O, also called non-preferential CO or general CO, does not have preferential treatment such as tariff reduction or exemption, the main purpose of this certificate is the basis for levying tariffs, trade statistics, safeguard measures, discriminatory quantitative restrictions, anti-dumping, countervailing etc, China issues normal C.O for most developing countries in the world.

You may ask: How much tax can I save after using FORM A? Well, tariff reduction and exemption are different for different products in different countries, it depends on the free trade agreement with China, you can check CHINA MINISTRY OF COMMERCE WEBSITE to find tax rate, and you can also call local import agent to check your products’ rate.

Who issues the Certificate of Origin in China?

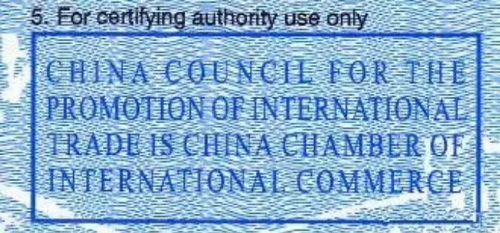

Usually a certificate of origin is issued by the local Chamber of Commerce, it is CCPIT in China, so CCPIT would issue China Certificate of Origin if the importers do not have any special requirement. CCPIT can issue all non-preferential C.O and most preferential C.O (such as FORM A, FORM B, FORM E, FORM F. FORM K but not including FORM P), there is a “CCPIT” logo and stamp on this kind of C.O.

Buyers from most developing countries (except those that have signed free trade agreements with China) in Africa, the Middle East, and Central and South America, would need this kind of normal certificate of origin issued by the CCPIT, but some countries such as Saudi Arabia, UAE and Egypt would ask for an extra “CHINA CHAMBER OF INTERNATIONAL COMMERCE” stamp, but CCPIT is CHINA CHAMBER OF INTERNATIONAL COMMERCE, so there would be a statement on the C.O, pls check below picture.

In addition, China Customs (former CIQ – China Inspection and Quarantine) can also issue certificate of origin in China. It can issue all kinds of C.O for many countries, the effect of certificate is the same as CCPIT’s, but it is more authoritative because China Customs is a government department. There is no “CHINA CUSTOMS” logo, but it has a stamp on this kind of C.O, the blanket certificate or origin template from China Customs is a little different from CCPIT’s. China customs and CCPIT are the only two institutions that can issue Certificate of Origin in China. China manufacturers and exporters can not issue C.O with their stamp, so it is impossible to get a manufacturer’s certificate of origin in China.

According to our experience in China furniture export business, customers from Middle East and North Africa area, such as the United Arab Emirates, Saudi Arabia, Egypt, and Israel, etc., all choose CCPIT certificate of origin China because they also need CCPIT (it is the China Chamber of Commerce) to certificate commercial invoices, doing both certificates in CCPIT is more convenient, and it can save more money in their local customs that using C.O from China Customs. Customers from other countries and areas are more likely to choose certificate of origin from China Customs, because it is more authoritative and has less chance to make troubles in custom clearance.

How to get certificate of Origin China

You can ask China suppliers to provide C.O, especially under incoterms such as FOB or CIF. Most China suppliers would apply for C.O as your requirements when preparing documents such as bills of lading, packing list, and commercial invoice. It doesn’t cost too much, but remember to check the draft of C.O (usually in Microsoft Word format) before making an official China Certificate of Origin. This is the best way to get Certificate of Origin China.

However, some manufacturers and companies in China may be reluctant to provide C.O and other related documents under EX-WORK incoterm, you must confirm details with your China suppliers before placing an order.

If you want to know how to apply for certificate of origin in China, here are two options:

Option 1

Register your China company in China Customs or CCPIT if it has China import and export license, then buy the certificate of origin declaration system after they approve the registration, you can apply for online certificate of origin and then print it after the system has been installed in office computer.

Option 2

Go to find an agent to apply for China certificate of origin if your company does not have China import & export license, many China agent companies are good at applying for certificate of origin in China, they have import & export license and have registered in CCPIT & China Customs.

What’s the difference? The exporter of C.O in option 1 is your company, no other companies, but the exporters of C.O in option 2 are the agent company and your company, meaning “agent company name O/B your company name”. The difference in exporter details would not affect custom clearance, unless Letter of Credit (one of the payment methods in international business) stipulates that document with third-party shippers or exporters is not accepted.

Just choose option 2 if you don’t have a huge demand for Certificate of Origin China, it would cost about 20-30 USD for one, the agent company would do the rest job after they get the payment and necessary documents, usually this China Certificate of Origin can be finished within one week. If you need large quantity Certificate of Origin in China and have company with import & export license, then you can do the application job by yourself or your employee instead of using an agent company in China.

Different types of C.O mat have different requirements, you can ask China suppliers to send a C.O draft before making the original one, then check the draft with a professional local import agent to see if it is OK, ask China suppliers to correct them if there are some mistakes.

How to fill the certificate of origin in China

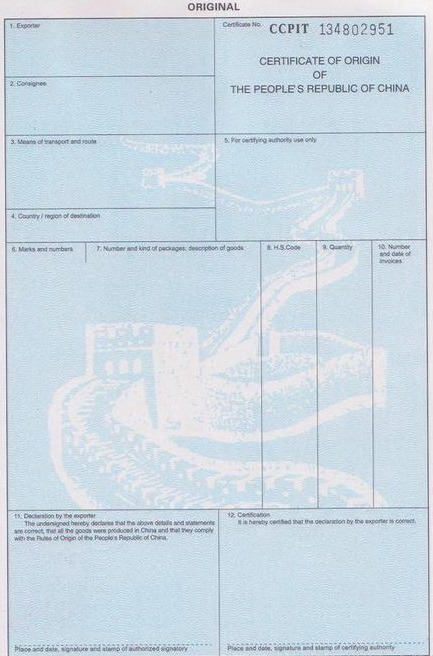

Let’s take a blank CCPIT Certificate of Origin as example, there are 12 columns in it, we will explain it one by one.

No.1 Column – Exporter

Name and address details of China supplier & exporter, you can write ON BEHALF OF (O/B)after China exporter and then add Hongkong or other countries company name & address details in this column, but you can’t only fill in non-China company only in this column.

No.2 Column – Consignee

Name, address and nationality of final consignee, it should be the same as consignee in bill of lading or letter of credit. Just write “to order” if you don’t know the final consignee.

No.3 Column – Means of transport and route

Just write “From (loading port, China) to (discharge port, country) BY SEA” if you import goods with sea shipping containers.

No.4 Column – Country/region of destination

It would be the same as consignee in No.2 column.

No.5 Column – For certifying authority use only

No need to write here, it is for special use, such as the “CCPIT is CHINA CHAMBER OF INTERNATIONAL COMMERCE” statement for Saudi Arabia, UAE and Egypt.

No.6 Column – Marks and numbers

We usually write “N/M” for furniture goods, N/M means No Marks. You can’t print “MADE IN (NON-CHINA COUNTRIES)” in marks.

No.7 Column – Number and kind of packages; description of goods

Just write it as the requirement, remember to write total package CTNS if there are different goods in it, and add **** in the last line to prevent adding fake content. Sometimes it may require to add invoice or L/C number under L/C payment term.

No.8 Column – H.S Code

You need to write down H.S Code for all items.

No.9 Column – Quantity

We usually write down gross weight of all goods in this column.

No.10 Column – Number and dates of invoice

The invoice number should be the same as commercial invoice for this goods, use abbreviation for the date, for example Aug 20, 2020, and the date here must be earlier than issue date.

No.11 Column – Declaration by the exporter

Exporter sign and stamp here, the date can’t be earlier than No.10 column invoice date.

No.12 Column – Certification

CIQ or CCPIT stamp here.

Summary

That’s our guide about Certificate of Origin in China, we hope it is helpful for you, RCEP (Regional Comprehensive Economic Partnership) has been started since Jan 1, 2022, we will make another post to introduce it, thank you for reading this post, we will be appreciate if you can leave a comment or share our post.